Aurora, Canopy quarterly results to show investors how far cost-cutting plans have come

Investors will get a taste of how some of Canada’s biggest cannabis companies are faring next week when Canopy Growth Corp. and Aurora Cannabis Inc. report their latest quarterly results.

It’s all but certain that both Aurora and Canopy will report a decline in revenue, mainly a sign of how fraught the Canadian market has been with an influx of competition, leaving analysts and investors alike attuned to how well those companies have continued to slash their costs in an ongoing effort to reach profitability.

Canopy Growth, which reports their fiscal third-quarter premarket on Feb. 9, is expected to post a six per cent annual decline in revenue to $137 million while booking a $105 million net loss, data from Bloomberg showed.

With one of the biggest cash reserves in the cannabis sector, Canopy will be closely watched to determine if the company has managed to ease its ongoing cash-burn in the wake of several quarters of steep writedowns and heavy losses. RBC Capital Markets Analyst Douglas Miehm writes in a preview note that Canopy continues to lose market share at a pace that’s greater than its peers, leading to another quarter of sequential revenue declines.

To become profitable, Canopy needs to book about $250 million in sales every quarter, leaving Miehm wondering how the company plans to achieve that when it is losing market share.

“We expect a focus on Canopy’s strategy to stabilize its market share in the recreational segment and the company’s progress on meeting the demand for higher THC products,” Miehm said in a report. He lowered his price target on Canopy’s stock to $17, from $26, while maintaining a “sector perform” recommendation.

The company is also expected to give an update on its search for a permanent chief financial officer and a chief product officer following the departure of two high-level executives late last year. Instead of expanding its Canadian presence, analysts expect Canopy to continue focusing on building out its various U.S. businesses where it can. Canopy is unable to derive any revenue yet from previous agreements to acquire Wana Brands and Acreage Holdings since cannabis is still federally illegal in the U.S., and generates 85 per cent of its U.S. sales from its Biosteel sports drinks, according to Piper Sandler.

Meanwhile, Aurora is expected to report $60 million in sales and an adjusted EBITDA loss of $12.6 million in its second-quarter results on Feb. 10, according to Bloomberg. The company has told investors that it should report profitability by the end of the calendar year.

CIBC Analyst John Zamparo notes that while U.S. regulatory reform has reignited investor interest in some cannabis names, he does not expect most Canadian producers to report any profits this year. He points out that Aurora’s cost-cutting plan should be evident in the upcoming quarterly release but expects the company to report profitability a year from now. Zamparo notched his price target on Aurora shares down to $6.50 from $9.25 and kept his “neutral” recommendation on its stock.

“This relies on continued growth in international sales, which can be lumpy, but we expect these to be strong in [fiscal] 2023, and we give credit on [selling, general, and administrative expenses] cuts, as Aurora has been able to achieve this in the past,” Zamparo said in a note.

THIS WEEK’S TOP STORIES

Hexo faces board fight with investor unimpressed by stock slide

Hexo, Canada’s biggest cannabis company by market share, is in the midst of a possible board fight between the company’s current director slate and an activist investor who said he is frustrated by the company’s current financial performance. Kaos Capital CEO Adam Arviv said he plans to nominate a slate of five independent directors, including himself, at Hexo’s upcoming annual general meeting in March. The announcement comes as Hexo shares have fallen by more than 91 per cent over the past year, which has also threatened the company’s listing on the Nasdaq. Arviv, who owns about two per cent of Hexo’s stock, previously sent Hexo’s board a letter in September demanding the resignation of then-CEO Sebastien St-Louis due to financial mismanagement. Hexo said Arviv’s statement is “disappointing” rather than working with the company to right its ship.

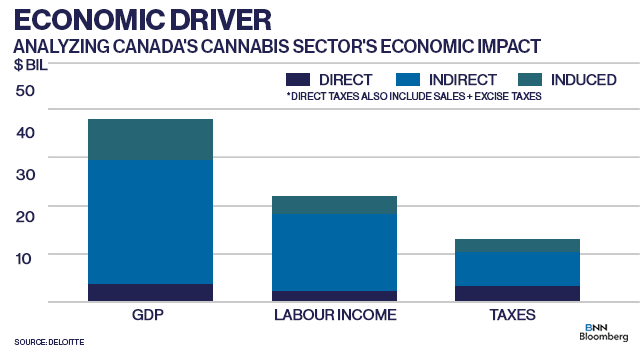

Legal cannabis market added $43.5B to Canada’s economy, supports 151k jobs

After three years of legalization, Deloitte released the most comprehensive economic analysis yet of how the Canadian cannabis sector has fared. The consultancy found that over the past three years, the cannabis sector has contributed $43.5 billion to the country’s economy, generated more than $15 billion in direct and indirect tax revenue for Canadian and provincial governments, while creating more than 151,000 jobs. Since 2018, Canadians have purchased $11 billion worth of cannabis, while the companies responsible for the production and sale of legal pot have spent $29 billion in capital expenditures during that time, Deloitte said. The report also highlighted ongoing challenges in the lack of diversity seen in Canada’s cannabis industry as well as the environmental impact that the industry bears.

Foreign workers hurt by recent cannabis production facility bankruptcy

The Toronto Star details how temporary foreign workers employed at a cannabis production facility in Leamington, ON have struggled to get paid for their work as the company that hired them goes through bankruptcy proceedings. Four migrant workers are seeking as much as $500,000 in payouts from PharmHouse, whose investors included cannabis investment company RIV Capital, the Star reported. As many as 57 migrant workers could file for unpaid wages, the newspaper added. Due to PharmHouse’s bankruptcy proceedings, many of the company’s former workers may find themselves at the end of the line when the company is formally dissolved as creditors often get paid first.

Oregon, Mississippi move forward on cannabis policy while Schumer looks to introduce reform bill in April

As U.S. politicians continue to find ways to include legislation aimed at doing business with cannabis companies easier, some states are looking to take a progressive approach in dealing with their legal marijuana issues. Oregon state authorities are looking to clamp down on the explosion of illegal pot farms that were recently highlighted in a recent Politico feature, according to the Huffington Post. Oregon’s cannabis regulator has noted an explosion in illicit grow-ops as many growers who claim to be legal hemp farmers are instead cultivating plants with illegal amounts of THC. Meanwhile, Mississippi is the latest state to legalize medical marijuana after the state’s governor signed off on a bill Wednesday, although dispensaries are expected to take months to open. Mississippi is now the 37th state to legalize cannabis for medical purposes. And on Friday, Senate Majority Leader Chuck Schumer announced he plans to formally file his cannabis reform bill in April, hours after the House of Representatives voted to included legislation aimed at allowing banks to do business with cannabis companies in a new domestic spending bill, Marijuana Moment reports.

ANALYST NOTE OF THE WEEK

Digging deep into Hifyre’s January sales data

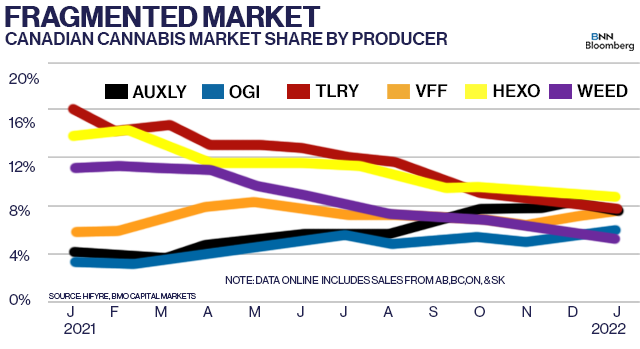

Canada’s cannabis industry is becoming increasingly fragmented, with many of the top players seeing their market share positions erode as more competition floods the market. That’s one of the main takeaways several analysts made after crunching preliminary January sales numbers from Hifyre earlier this week.

CIBC Analyst John Zamparo notes that the total share of sales among the country’s 10 largest cannabis producers is 63 per cent compared to 78 per cent a year earlier. It’s a likely sign that no matter how much companies invest in their brands, the sheer amount of new releases and lack of consumer stickiness for certain products continue to weigh on the industry. Zamparo also notes that the Canadian industry is a month or so away from having no single company control more than 10 per cent of the market.

Meanwhile, BMO Capital Markets Analyst Tamy Chen estimates that sales in January will take an eight per cent dip to about $365 million following a strong December that was packed with holiday selling activity. Drilling down into product categories, Chen notes that certain segments of the Canadian market such as vapes and edibles now have clear industry leaders while other segments like dried flower remain highly fractured. That’s likely because products like vapes and edibles may have lower barriers of entry for producers while the capital requirements to set up a flower cultivation facility may be too onerous for some.

The Hifyre data shows that the country’s biggest companies like Canopy Growth, Hexo, Tilray, and Cronos Group all lost substantial market share while Auxly also saw some of its upward momentum stall in January. Village Farms and Organigram reported positive share gains in the month, the data showed. Interestingly, while Tilray and Hexo remain atop the charts, the top five producers are only a couple of percentage points apart.

CANNABIS SPOT PRICE

$5.05 per gram

— This week’s price is down 0.4 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$1,802 per pound at current exchange rates.

WEEKLY BUZZ

2,946

– The number of licensed cannabis retailers in Canada as of Jan 31.